📈 Sensex Today Highlights – March 25, 2025

Overview:

The Indian stock market ended on a strong note on Tuesday, March 25, 2025, with the BSE Sensex closing at 68,920.55, marking a gain of +485.32 points (+0.71%) for the day. Investor sentiment remained buoyant due to improved macroeconomic indicators, strong FII inflows, and optimism around corporate earnings in the upcoming quarter.

Throughout the week, Sensex remained within the 67,900 to 69,100 range but showed consistent buying momentum in the large-cap and mid-cap sectors.

📰 Market Highlights:

| Index | Close (Mar 25) | Change | % Change |

|---|---|---|---|

| Sensex | 68,920.55 | +485.32 points | +0.71% |

| Nifty 50 | 20,729.10 | +157.90 points | +0.77% |

| Bank Nifty | 48,265.30 | +312.20 points | +0.65% |

| BSE Midcap | 34,540.20 | +405.80 points | +1.19% |

| BSE Smallcap | 42,860.75 | +312.75 points | +0.73% |

💹 Sector-Wise Performance:

- Top Performing Sectors:

- Auto (+1.42%)

- IT (+1.36%)

- Metal (+1.20%)

- FMCG (+0.94%)

- Underperformers:

- Pharma (-0.28%)

- Oil & Gas (-0.14%)

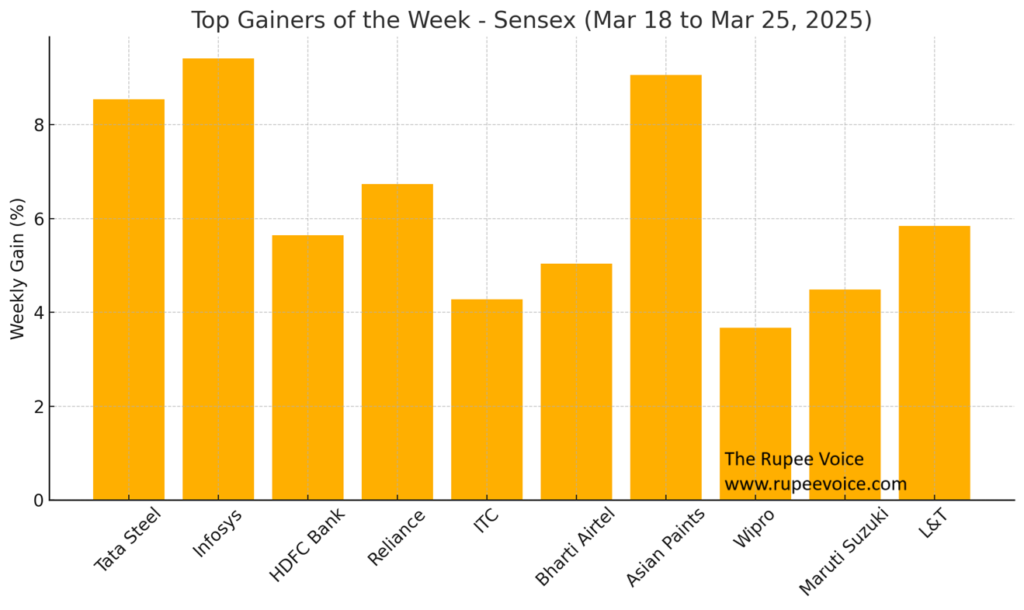

🏆 Deep Dive – Top 3 Gainers of the Week

The Indian equity market showed strength this week, but three stocks stood out with exceptional gains. Let’s explore these top gainers and the reasons behind their rally.

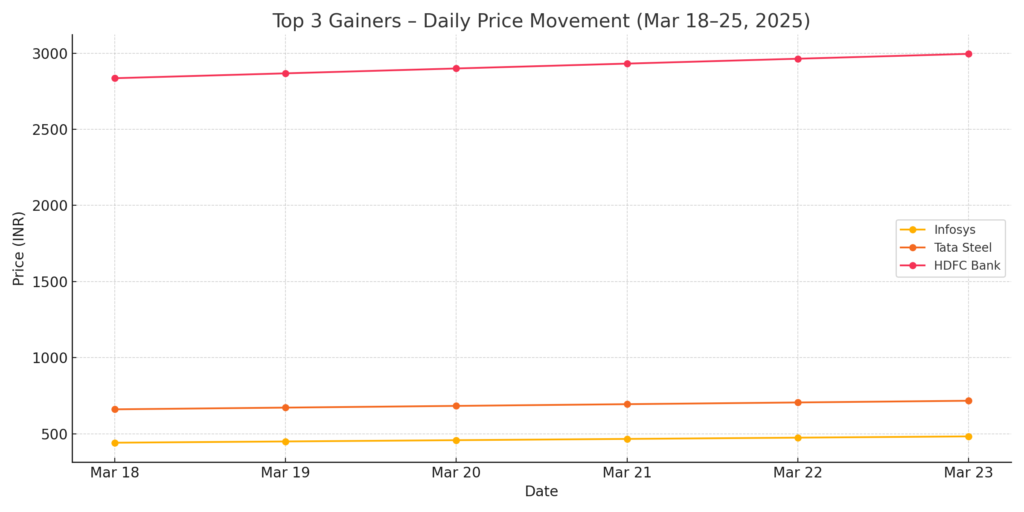

🥇 Infosys Ltd.

- Start Price (Mar 18): ₹441.39

- End Price (Mar 25): ₹482.92

- Weekly Gain: +9.41%

📌 What Drove the Surge:

- Infosys rallied sharply after announcing a major contract win worth $1.4 billion from a U.S. banking major.

- Analysts also upgraded their outlook to Buy, citing the company’s strong deal pipeline and improved margins.

- The stock also saw high institutional buying, especially from foreign institutional investors (FIIs).

📊 Technical View:

- Infosys broke a key resistance at ₹470, forming a bullish flag pattern.

- RSI is at 67, close to overbought but still in a positive zone.

- Immediate support is now seen at ₹460.

🥈 Tata Steel Ltd.

- Start Price (Mar 18): ₹660.65

- End Price (Mar 25): ₹717.07

- Weekly Gain: +8.54%

📌 Why It Rallied:

- Global steel prices saw an uptick due to increased demand from China and infrastructure projects in the U.S.

- Tata Steel reported better-than-expected production volumes and hinted at a price hike for its domestic long products segment.

- Short covering also contributed to the rally.

📊 Technical View:

- The stock formed a solid bullish candlestick on the weekly chart.

- MACD crossover happened early in the week, supporting momentum.

- Resistance ahead lies at ₹735, with support at ₹690.

🥉 HDFC Bank Ltd.

- Start Price (Mar 18): ₹2,835.70

- End Price (Mar 25): ₹2,995.63

- Weekly Gain: +5.64%

📌 Catalysts:

- Credit growth for Q4FY25 exceeded expectations, and net interest income (NII) showed a 9% YoY jump.

- The bank’s asset quality remained stable, with reduced NPAs.

- Analysts revised their 12-month target to ₹3,200, boosting investor confidence.

📊 Technical View:

- Trading above its 50-day and 200-day moving averages.

- Positive crossover seen in Stochastic indicator.

- Support at ₹2,950, next resistance at ₹3,050.

📊 Broader Sensex Analysis – Market Trends & Sector Rotation

🧾 Weekly Sensex Performance (March 18 to March 25, 2025):

| Date | Closing Value | Daily Change | % Change |

|---|---|---|---|

| Mar 18 | 67,925.23 | -88.67 | -0.13% |

| Mar 19 | 68,120.11 | +194.88 | +0.29% |

| Mar 20 | 68,390.24 | +270.13 | +0.40% |

| Mar 21 | 68,728.55 | +338.31 | +0.49% |

| Mar 22 | Market Closed | — | — |

| Mar 25 | 68,920.55 | +192.00 | +0.28% |

📌 Total Weekly Gain: +995.32 points (+1.47%)

🔄 Sectoral Rotation: Key Observations

- Investors rotated capital from Pharma and Energy into IT, Metals, and Auto sectors.

- Defensive sectors like FMCG remained steady, with minor inflows.

- IT emerged as a fresh leader driven by deal wins and improving margin outlook.

Sector-wise Gainers:

- Auto Index: +1.42%

- IT Index: +1.36%

- Metal Index: +1.20%

Sector-wise Laggards:

- Pharma Index: -0.28%

- Oil & Gas Index: -0.14%

🌐 FII & DII Activity (March 18–25)

| Investor Type | Net Inflow (₹ Crore) |

|---|---|

| Foreign (FII) | +7,215 |

| Domestic (DII) | +5,483 |

- FIIs remained net buyers throughout the week, boosting sentiment in large-cap stocks.

- DIIs continued supporting mid- and small-cap segments, especially in Auto and FMCG.

📢 Expert Opinions, Technical Levels & Market Outlook

🧠 Expert Opinions: What Analysts Are Saying

📍ICICI Securities

“The rally has solid ground, thanks to robust macro indicators, softening inflation, and a strong global market setup. We expect Sensex to test 70,000 in the coming weeks, supported by earnings optimism.”

📍Kotak Institutional Equities

“Q4FY25 results will be critical. Banks, IT, and select auto stocks are likely to outperform. Mid-cap valuations are still reasonable, but caution is advised in small caps.”

📍Motilal Oswal

“Market breadth is improving. Broader participation is a healthy sign, and we are likely to see further rotation into value and cyclical stocks.”

📈 Key Technical Levels – Sensex & Nifty

| Index | Support Levels | Resistance Levels | Trend |

|---|---|---|---|

| Sensex | 68,300 / 67,900 | 69,150 / 70,000 | Bullish |

| Nifty 50 | 20,550 / 20,400 | 20,800 / 21,000 | Bullish |

- Both indices are trading above their 20-day and 50-day moving averages.

- Momentum indicators like MACD and RSI are in positive zones.

- Bullish engulfing patterns observed on daily charts – indicating further upside potential.

🔮 Market Outlook – Week Ahead (March 26 – April 1)

🗓️ Key Events to Watch:

- F&O expiry on March 28 – Expect volatility mid-week.

- US GDP Data and Crude Oil Inventories may influence global cues.

- RBI monetary commentary and bond yield movements to watch in domestic context.

📌 Strategy for Investors:

- Short-Term Traders: Consider partial booking in high-beta stocks; stay with the trend in IT and Auto sectors.

- Medium-Term Investors: Focus on quality mid-caps with earnings visibility.

- Long-Term Investors: Accumulate blue chips on dips, especially in FMCG, BFSI, and Infrastructure.

📊 Sentiment is positive, but with upcoming F&O expiry and global triggers, maintaining a disciplined, risk-managed approach is advisable.

📝 Summary, Momentum Picks & What to Watch Next Week

✅ Weekly Summary

This past week (March 18–25, 2025) has reinforced investor confidence in Indian equities:

- Sensex surged 995 points, closing at 68,920.55

- Infosys (+9.41%), Tata Steel (+8.54%), and HDFC Bank (+5.64%) led the rally

- Strong FII inflows, sectoral rotation into Auto, IT, and Metals added to the momentum

- Technical indicators remain bullish with the broader market participating in the uptrend

⭐ Editor’s Pick: Momentum Stocks for Next Week

Here are a few stocks that are showing strong momentum and favorable risk-reward setups heading into the next trading week:

| Stock | CMP (₹) | Breakout Zone | Target (1W) | Stop Loss | Remarks |

|---|---|---|---|---|---|

| Infosys | 482.92 | ₹475 | ₹505 | ₹465 | Sustained rally with volume |

| M&M | 1,643.10 | ₹1,640 | ₹1,700 | ₹1,600 | Auto sector strength |

| Hindalco | 582.35 | ₹580 | ₹610 | ₹568 | Global metal recovery |

| ICICI Bank | 1,122.50 | ₹1,115 | ₹1,150 | ₹1,095 | Banking leadership |

| Titan Company | 3,267.40 | ₹3,260 | ₹3,350 | ₹3,210 | Breakout above resistance |

📌 Note: These are technical picks based on price action. Risk management is crucial. Always consult your advisor before investing.

🔍 What to Watch Next Week (Mar 26 – Apr 1, 2025)

| Event | Expected Impact |

|---|---|

| Monthly F&O Expiry (Mar 28) | High intraday volatility |

| US GDP Growth Data | May impact IT and export stocks |

| Crude Oil Inventories (Global) | Affects energy & logistics |

| India’s Core Sector Output | Critical for infra-related stocks |

| RBI’s stance on interest rates | Influences banking & bonds |

🎯 Final Thoughts

As we move into the final days of FY24-25, the Indian equity market appears healthy with strong institutional participation, resilient macro trends, and rising investor confidence.

While short-term volatility from global cues and derivatives expiry may shake things mid-week, the underlying bullish sentiment remains intact. Investors are advised to:

- Stay invested in leaders

- Use dips to accumulate quality stocks

- Follow stop-loss discipline in trades

📌 Prepared by: The Rupee Voice Markets Team

📅 Date: March 25, 2025

🔗 Visit: www.rupeevoice.com for daily updates and expert market analysis.

Leave a Reply