📅 Weekly Snapshot (March 28 – April 03, 2025)

- Nifty 50: Closed at 22,410 (+0.7% WoW)

- Sensex: Closed at 74,120 (+0.6% WoW)

- Bank Nifty: Closed at 49,520 (+1.1% WoW)

- FIIs: Net buyers – ₹4,820 crore

- DIIs: Net sellers – ₹1,340 crore

This data suggests foreign institutions remain bullish, while domestic investors booked some profits ahead of the new earnings season.

🔍 Key Highlights & Market Drivers

🌍 1. Global Sentiment

- U.S. markets ended positively, anticipating Fed rate cuts in Q2.

- Crude oil prices remained under $83 per barrel, easing inflation concerns for India.

- 🔥 Trump’s renewed tariff war with China has revived global trade tensions. This trade war is expected to increase costs for U.S. importers and push manufacturers to shift their base to emerging markets like India.

India could benefit from this shift as companies seek alternatives to Chinese manufacturing in sectors such as textiles, auto parts, electronics, and engineering goods.

🇮🇳 2. Domestic Economic Indicators

- Manufacturing PMI rose to 56.4, reflecting solid economic activity and factory output growth.

- GST collections hit ₹1.79 lakh crore in March, showing strong consumer demand and tax compliance.

- The upcoming RBI Monetary Policy Committee meeting on April 12 will be a key event, although no repo rate hike is expected.

📊 Technical Outlook: Nifty 50

The Nifty 50 continues to hold above its major support levels, showing strength.

- Support Zone: 22,200 – 22,050

- Resistance Zone: 22,500 – 22,700

- Trend: Sideways to mildly bullish; a breakout above 22,500 could trigger a rally.

🔧 Indicators:

- RSI: 61 – Neutral to bullish; room for upside without being overbought

- 50-Day Moving Average: Strong support at 21,880

- MACD: Positive crossover; watch for confirmation above 22,500

These indicators suggest bullish sentiment with caution, especially as global headlines (like tariffs) may influence investor emotions.

🏦 Sector Outlook

🔼 Bullish Sectors:

- Banking & Financial Services:

- Strong credit growth and positive margin outlook.

- Private banks like ICICI Bank and HDFC Bank are market leaders right now.

- Capital Goods & Infrastructure:

- Ongoing public sector spending and PLI schemes support L&T, Siemens, and ABB.

- Auto Sector:

- Electric Vehicle (EV) segment driving growth.

- Companies like Tata Motors and Bajaj Auto are seeing strong retail demand.

🔽 Sectors to be Cautious About:

- Information Technology (IT):

- Anticipated weak Q4 earnings and slowdown in U.S. tech spending may put pressure on stocks like Infosys and Wipro.

- Pharma:

- After a strong 2-month rally, profit-booking is likely, especially in mid-sized pharma counters.

📊 Stock Focus, Events Calendar & Strategy Guide

📈 Top Stocks to Watch (April 04–09, 2025)

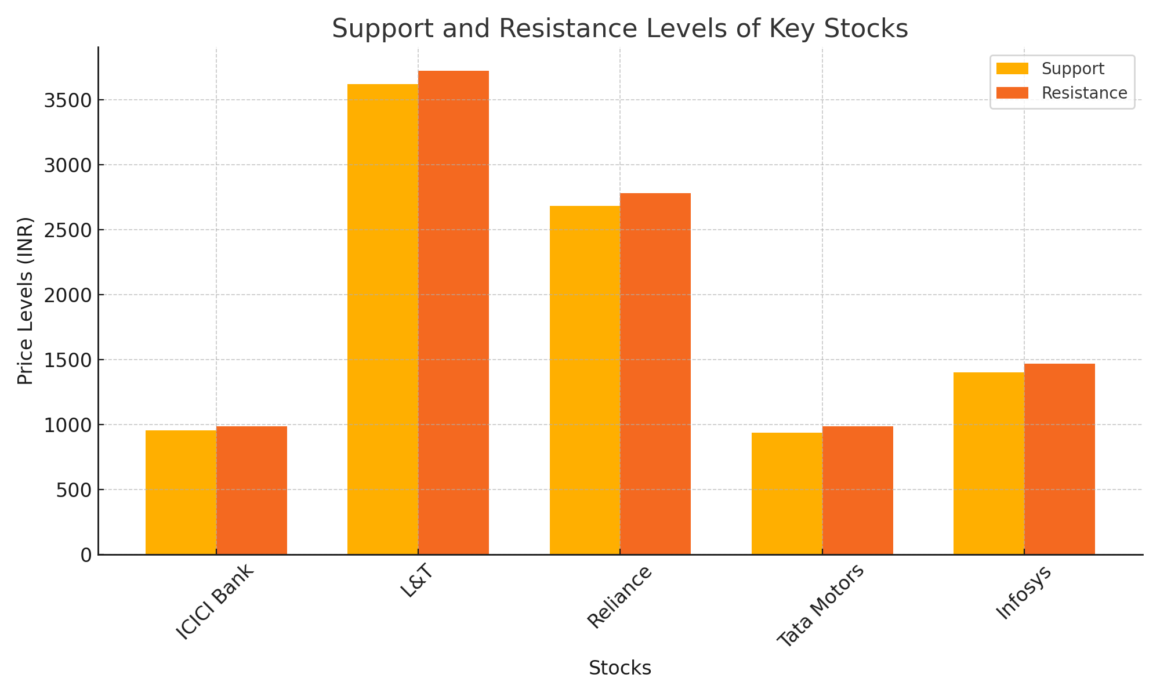

Here are 5 well-positioned stocks based on technical breakout zones, recent delivery volumes, and sector strength:

| Stock | Why to Watch | Support Price | Resistance Price |

|---|---|---|---|

| ICICI Bank | Near breakout, strong delivery volume | ₹955 | ₹985 |

| L&T | Infra momentum, order book expansion | ₹3,620 | ₹3,720 |

| Reliance | Break above ₹2,700 could trigger sharp rally | ₹2,680 | ₹2,780 |

| Tata Motors | EV segment strength, strong sales performance | ₹940 | ₹985 |

| Infosys | High volatility expected ahead of Q4 results | ₹1,400 | ₹1,470 |

📌 Note: These stocks should be monitored closely at opening bell hours for volume-based moves.

🗓️ Events Calendar (April 04 – 09, 2025)

| 📆 Date | 🗂️ Event Description |

|---|---|

| Apr 04 | Weekly Options Expiry (Nifty & Bank Nifty) |

| Apr 05 | U.S. Non-Farm Payroll & Unemployment Data |

| Apr 07 | Earnings Previews: TCS & Wipro (Q4 FY24-25) |

| Apr 09 | OPEC+ Meeting – Crude supply decision |

👉 These events may influence sector volatility, especially in IT, energy, and commodities.

🧠 Strategy Guide for Traders & Investors

🟠 For Intraday and Swing Traders:

- Focus on breakouts from consolidation (ICICI, L&T).

- Avoid sectors with low momentum or pre-earnings volatility (Infosys).

- Prefer high beta stocks with clean chart patterns.

- Use tight stop-losses to protect against global risk headlines (e.g. tariffs, Fed speeches).

🟢 For Long-Term Investors:

- Accumulate on dips in:

- Large-cap private banks (ICICI, Axis)

- Infra leaders (L&T, Siemens)

- Auto leaders (Tata Motors, Maruti)

- Wait for post-earnings clarity before adding more IT sector stocks.

- Watch for policy announcements in energy, railways, and defence ahead of elections.

💬 Expert Opinion

“With India emerging as a potential winner from global supply chain shifts triggered by trade wars and stable macro indicators at home, the market outlook remains constructive. Focus on sectors aligned with domestic growth.”

— Anjali Deshmukh, Chief Market Strategist, The Rupee Voice

📝 Final Thoughts, Summary & Sharing

🧾 Final Thoughts

As we move into the heart of April 2025, the Indian stock market reflects a balance of optimism and caution. On one hand, we see:

✅ Strong GST collections

✅ Expanding PMI data

✅ Positive FII flows

✅ Resilience in key sectors like banking, auto, and infrastructure

But on the other hand, volatility may increase due to:

⚠️ Global uncertainties, including the Trump–China tariff war

⚠️ Upcoming earnings season in the IT sector

⚠️ Ongoing geopolitical risks and crude price movements

This combination sets the stage for a tactical trading environment where success depends on:

- Timely entry/exit

- Sector rotation understanding

- Staying updated with global cues

📊 Visual Summary Notes

Here’s a quick recap of what matters most this week:

- 📈 Nifty 50: Range-bound between 22,200–22,700, bullish bias

- 🏦 Bank Nifty: Outperforming; heading towards 50,000

- 💼 Sectors to Focus: Banking, Infrastructure, Auto

- 🔍 Event Risks: U.S. jobs data, Q4 earnings, Trump tariffs, OPEC+

📢 Social Sharing Caption (For WhatsApp, Instagram, LinkedIn)

📊 Indian Stock Market Outlook: April 04–09, 2025

Nifty eyes breakout as earnings season approaches. FIIs remain bullish. Trump’s tariff war adds global tension.

👉 Full report on The Rupee Voice → www.rupeevoice.com

🔁 Share with fellow traders & investors!

✅ Summary in One Line

Smart strategy, sector focus, and risk management are key to winning this week in the markets.

🔚 End of Report

Prepared by: The Rupee Voice Editorial Team

Website: www.rupeevoice.com

Follow us on: Instagram | LinkedIn | WhatsApp | YouTube

Leave a Reply