Intraday trading, or day trading, involves buying and selling stocks within the same trading day. It’s fast, exciting, and potentially profitable—but only for those who approach it with a strategy. In 2025, with improved trading platforms, tighter regulations, and more educated investors, intraday trading has become more competitive than ever.

Let’s explore actionable intraday strategies that can help you trade better and safer in today’s market.

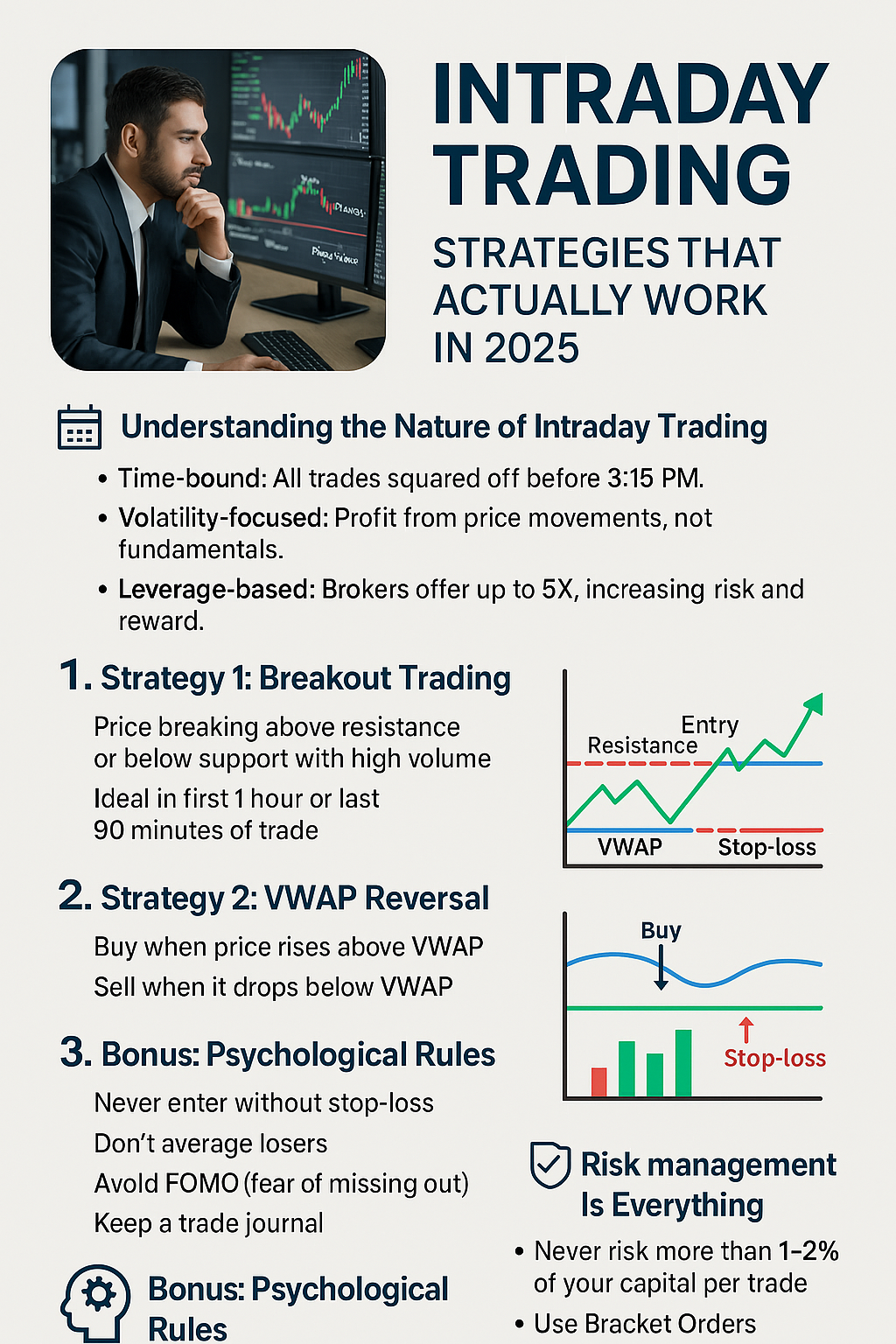

⏰ Understanding the Nature of Intraday Trading

- Time-bound: All trades must be squared off before 3:15 PM.

- Volatility-focused: Profit comes from price movements, not fundamentals.

- Leverage-based: Brokers offer up to 5X (per SEBI rules), increasing risk and reward.

It’s not gambling—it’s calculated speculation based on price action, volume, and chart patterns.

📊 Strategy 1: Breakout Trading

What to look for:

- Price breaking above resistance or below support with high volume.

- Ideal in the first 1 hour or last 90 minutes of trade.

Tool to use:

- Volume candles, Pivot Points, SuperTrend indicators.

Example:

- If Reliance breaks ₹2,400 with volume spike, go long with SL ₹2,370.

📉 Strategy 2: VWAP Reversal

VWAP (Volume Weighted Average Price) helps detect overbought/oversold zones intraday.

- Buy when price drops below VWAP and reclaims it.

- Sell when price is above VWAP and starts dropping with volume.

Use for: Nifty, Bank Nifty, high-volume stocks.

📈 Strategy 3: Momentum Scalping

Ideal for fast movers like: Adani Ent, Tata Steel, SBI

- Use 5-min charts

- Look for candles breaking recent highs/lows with rapid volume.

- Set tight SL (~0.5%) and quick profit (~1%)

🧠 Bonus: Psychological Rules

- Never enter without a stop-loss.

- Don’t average losers.

- Avoid FOMO (fear of missing out).

- Keep a trade journal.

“In intraday, discipline > prediction.”

💡 Risk Management Is Everything

- Never risk more than 1–2% of your capital per trade.

- Use Bracket Orders (BO) or Cover Orders (CO) for auto SL & Target.

- If you hit 2 SLs in a row, exit for the day.

📲 Best Tools for Intraday Traders

- TradingView + Kite/Upstox Pro for live charts

- Screener Alerts for volume spikes

- Economic calendar for news-based volatility

- Telegram groups (verified only!) for crowd sentiment

🚀 Top 5 Stocks to Watch Intraday (Updated Daily)

| Stock | Entry Level | SL | Target |

|---|---|---|---|

| HDFC Bank | ₹1,580 | ₹1,565 | ₹1,610 |

| Infosys | ₹1,450 | ₹1,438 | ₹1,475 |

| Tata Motors | ₹950 | ₹940 | ₹975 |

| ICICI Bank | ₹970 | ₹955 | ₹995 |

| LT | ₹3,650 | ₹3,625 | ₹3,700 |

These are NOT investment recommendations. Always do your own analysis.

✅ Final Checklist Before Every Trade

- ☐ Market direction (bullish/bearish/sideways)

- ☐ Watchlist of 3–5 stocks

- ☐ Levels marked: Entry, SL, Target

- ☐ News & events cleared

- ☐ Mental clarity: No revenge trading

🧾 Final Thoughts

Intraday trading is not just skill—it’s mindset, strategy, and risk control combined. In 2025, tools and data are at your fingertips. But it’s your discipline that will separate wins from losses.

Take small, consistent trades. Respect stop-losses. And always trade with a plan.

Leave a Reply