The Rupee Voice Desk

Market Overview & Economic Context

Global & Domestic Economic Sentiment: The Indian stock market is entering the final week of March 2025 with renewed optimism. A global reduction in interest rate fears, stabilizing crude oil prices, and improving macroeconomic indicators are boosting confidence. Domestically, India’s inflation has cooled to 4.6%, the rupee has remained stable, and foreign portfolio investment (FPI) outflows have slowed significantly.

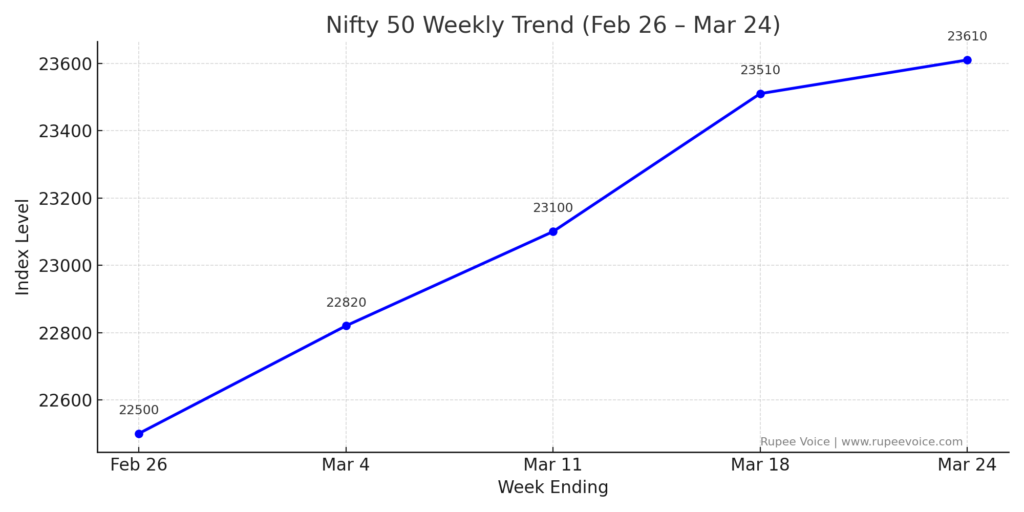

Previous Week’s Performance:

The Nifty 50 rallied over 4.26% and the Sensex gained 4.16% in the week ending March 21, 2025. The rally was led by banking, financials, and energy sectors. Notably, PSU banks and select auto stocks saw high delivery-based buying.

| Index | Last Week Close | Weekly Gain (%) | YTD (%) |

|---|---|---|---|

| Nifty 50 | 23,510 | +4.26% | +5.90% |

| Sensex | 77,200 | +4.16% | +5.45% |

| Bank Nifty | 51,420 | +5.05% | +6.10% |

| Nifty Midcap | 45,190 | +3.75% | +10.3% |

Technical Snapshot:

- Nifty support levels: 23,000 and 22,750

- Nifty resistance levels: 23,600 and 23,850

- Bank Nifty may test 52,000 if momentum continues

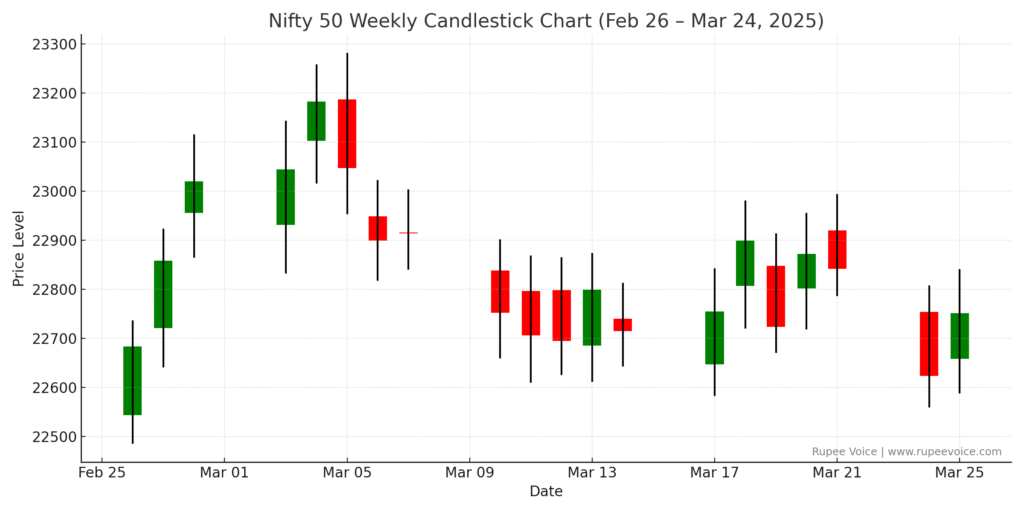

Chart 1: Nifty 50 Weekly Candlestick Chart

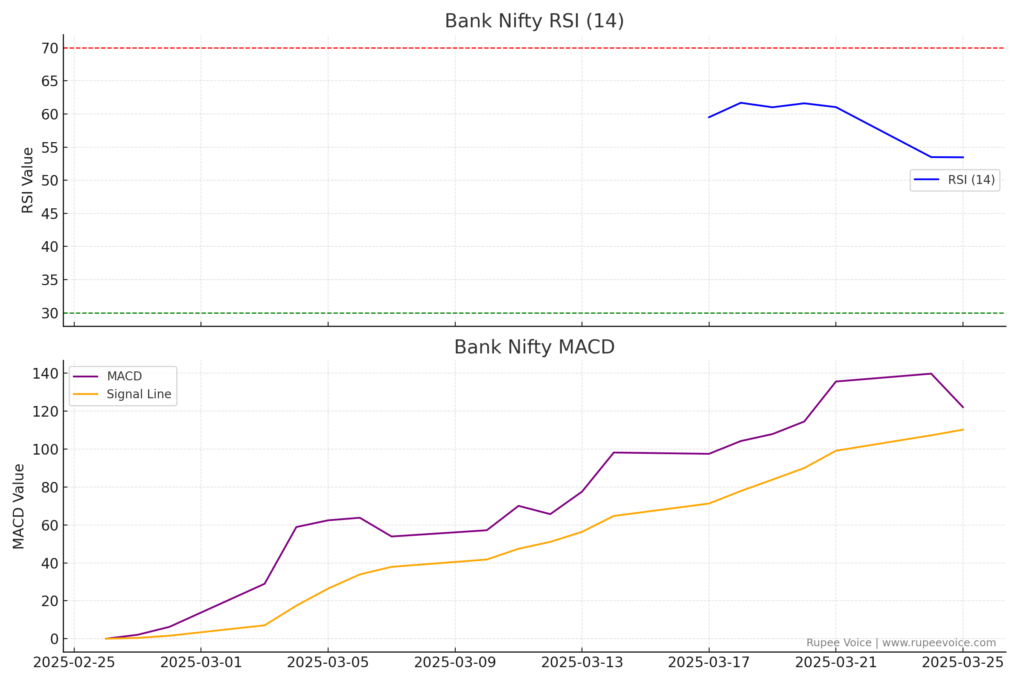

Chart 2: Bank Nifty RSI & MACD Chart

Major Drivers to Watch:

- U.S. Fed policy hints on interest rate cuts

- Crude oil stability below $80

- Rupee performance vs USD

- India Inc. Q4 pre-earnings outlooks

- Geo-political tensions (especially in the Middle East)

Sectoral Summary:

| Sector | Performance (Weekly) | Key Stocks Driving Rally |

|---|---|---|

| Banking | +5.5% | HDFC Bank, SBI, ICICI Bank |

| Energy | +4.2% | ONGC, Reliance, Adani Green |

| Auto | +3.1% | Tata Motors, Maruti, M&M |

| FMCG | +1.2% | ITC, Hindustan Unilever |

| IT | +0.9% | TCS, Infosys, Wipro |

Stocks to Watch, Options Strategy & Technical Levels

🔍 Top Stocks to Watch This Week:

| Stock Name | Sector | Reason to Watch | Key Levels (Support/Resistance) |

|---|---|---|---|

| HDFC Bank | Banking | Strong FII buying; high delivery volume | 1,525 / 1,600 |

| Reliance Industries | Energy | Technical breakout on weekly chart | 2,950 / 3,080 |

| Tata Motors | Auto | Strong EV orderbook, volume spike | 985 / 1,050 |

| ITC | FMCG | Dividend payout + defensive play | 445 / 468 |

| Infosys | IT | Weak rupee support + RSI reversal | 1,530 / 1,600 |

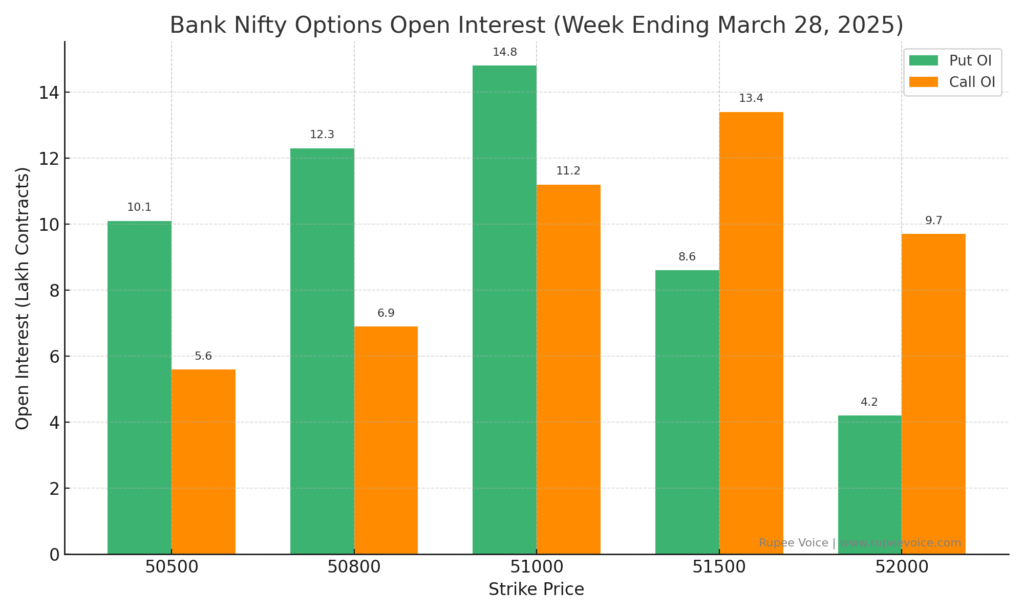

📈 Options Setup for the Week:

Nifty 50:

- Max Pain: 23,500

- PCR (Put-Call Ratio): 1.12 – moderately bullish

- Notable OI Build-up:

- Call: 23,600CE, 23,800CE

- Put: 23,200PE, 23,400PE

Bank Nifty:

- Max Pain: 51,000

- PCR: 1.19 – bullish

- Notable OI Build-up:

- Call: 51,500CE, 52,000CE

- Put: 50,500PE, 50,800PE

🧮 Options Strategy Suggestion (For Advanced Traders):

Nifty Bull Call Spread:

- Buy 23,500 CE

- Sell 23,800 CE

- Net debit: ~₹85

- Max profit: ₹215

Bank Nifty Iron Condor:

- Sell 50,500 PE + 52,000 CE

- Buy 50,200 PE + 52,300 CE

- Premium received: ~₹220

- Breakeven: 50,350–52,150

📊 Chart 3: Options Open Interest (Nifty & Bank Nifty)

🔧 Technical Summary

| Index | Bias | Indicators Confirming |

|---|---|---|

| Nifty 50 | Bullish | RSI 60+, MACD crossover |

| Bank Nifty | Bullish | Price > 20 EMA + Volume |

📌 Note: Watch for expiry-related volatility on March 28 (Thursday).

ETF Trends, Mutual Fund Flows & Sectoral Allocation

📊 Exchange Traded Fund (ETF) Trends

ETFs have increasingly become a preferred investment vehicle for retail and institutional investors due to their liquidity, low cost, and transparency. Here’s a breakdown of popular ETFs and their current trends:

| ETF Name | Type | Last Week Change (%) | YTD Return (%) | Sector Exposure |

|---|---|---|---|---|

| Nippon India Nifty BeES | Index ETF | +4.2% | +6.3% | Nifty 50 |

| ICICI Pru Bank ETF | Sectoral | +5.1% | +8.9% | Banking |

| SBI PSU ETF | Sectoral | +4.9% | +11.2% | PSU Banks |

| Motilal Oswal Nasdaq 100 | Global | +3.8% | +10.1% | Tech (US exposure) |

| HDFC Gold ETF | Commodity | +0.5% | +3.5% | Gold |

🔁 Mutual Fund Inflows & Allocation (Feb–Mar 2025)

🟢 Equity-Oriented Inflows (Estimated):

- Total net inflow: ₹19,000 crore

- Small-Cap Funds: ₹6,200 crore

- Flexi-Cap Funds: ₹5,500 crore

- Large-Cap Funds: ₹3,100 crore

- ELSS: ₹1,400 crore

🔴 Debt-Oriented Flows:

- Net outflows due to rate uncertainty

- Ultra-short and liquid funds saw minor redemptions

🟢 Hybrid/Balance Advantage Funds:

- Continued inflows (~₹2,500 crore)

- Sign of long-term investor confidence

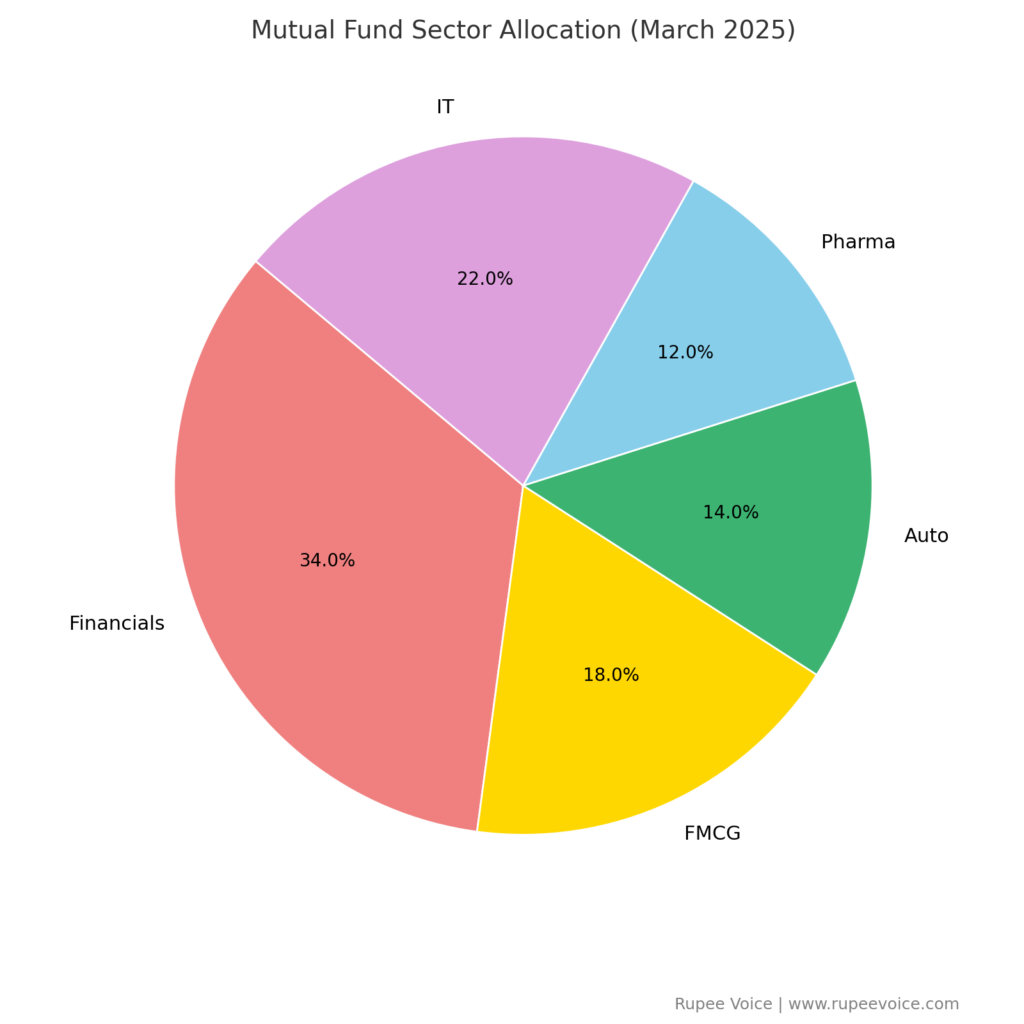

📈 Sectoral Allocation Trends by Mutual Funds

| Sector | Weightage Change | Reason |

|---|---|---|

| Financials | ⬆ +1.5% | Better margins, credit growth |

| FMCG | ➡ Stable | Defensive play, margin holding |

| Auto | ⬆ +0.8% | Recovery in rural demand |

| Pharma | ⬇ -0.6% | Profit booking, valuation |

| IT | ➡ Stable | Rupee advantage offset by US concerns |

📊 Chart 4: Mutual Fund Sectoral Allocation Breakdown

💡 Takeaway for Investors:

- ETFs tracking core indices and banking are seeing strong interest

- Mutual fund flows are healthy in equity and hybrid categories

- Sector rotation is ongoing—watch for increased exposure to auto, infra, and financials

Dividend & Corporate Action Tracker + FII/DII Activity

🧾 Dividend Announcements & Corporate Actions

Several companies are set to announce or distribute dividends during the week. This offers a short-term income opportunity for long-term investors and dividend chasers.

| Company Name | Type of Action | Record Date | Dividend (₹) | Ex-Date |

|---|---|---|---|---|

| TVS Motor | Final Dividend | 25-Mar-2025 | ₹27.35 | 22-Mar-2025 |

| REC Ltd | Interim | 26-Mar-2025 | ₹3.75 | 24-Mar-2025 |

| Authum Investment | Interim | 27-Mar-2025 | ₹1.00 | 25-Mar-2025 |

| Ksolves India | Final Dividend | 28-Mar-2025 | ₹5.00 | 26-Mar-2025 |

| KBC Global | Interim | 27-Mar-2025 | ₹0.50 | 25-Mar-2025 |

📦 Bonus / Split Announcements:

- No bonus or stock splits announced this week so far.

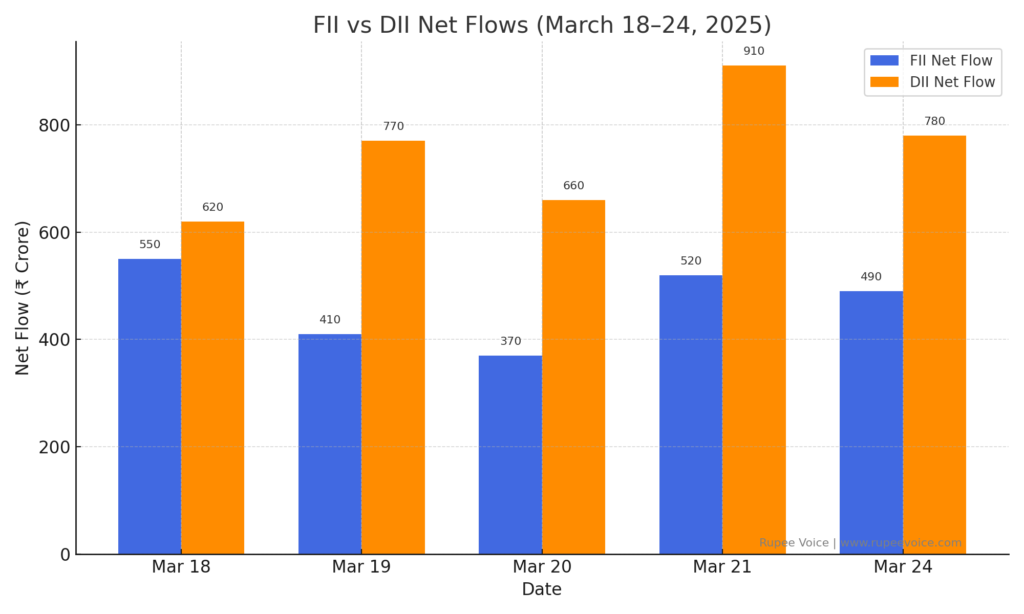

🌍 FII/DII Trading Activity

Investor sentiment and institutional flows play a critical role in market trends. Here’s how institutional investors have acted recently:

🟢 Foreign Institutional Investors (FIIs):

- Net Buying (Past Week): ₹1,850 crore

- Sector preference: Banking, large-cap IT, infra

- Selling subdued due to global dovish outlook from US Fed

🔵 Domestic Institutional Investors (DIIs):

- Net Buying (Past Week): ₹2,960 crore

- Sector focus: FMCG, auto, financials

- Mutual funds and LIC have picked up momentum in select PSUs

📈 Chart 5: Net FII vs DII Weekly Flow (March 2025)

FII Activity Tracker – March 2025

| Date | Net Inflow/Outflow (₹ crore) |

|---|---|

| Mar 18 | +₹550 crore |

| Mar 19 | +₹410 crore |

| Mar 20 | +₹370 crore |

| Mar 21 | +₹520 crore |

| Mar 22 | Holiday |

DII Activity Tracker – March 2025

| Date | Net Inflow (₹ crore) |

|---|---|

| Mar 18 | +₹620 crore |

| Mar 19 | +₹770 crore |

| Mar 20 | +₹660 crore |

| Mar 21 | +₹910 crore |

| Mar 22 | Holiday |

Indian Stock Market Outlook: March 24–28, 2025

Page 5: Expert Outlook, Risk Factors, and Strategy for Traders & Investors

👨💼 Expert Outlook & Institutional Commentary

Market analysts and fund managers remain cautiously optimistic for the short-term, backed by:

- Cooling inflation

- Softer US Fed tone

- Pre-election optimism in India

Motilal Oswal: “The base is building for the next leg of rally, especially in auto, banking and infra stocks. Stick to quality midcaps.”

HDFC Securities: “Watch for volatility around derivatives expiry on March 28. A breakout in Nifty beyond 23,800 will confirm a new uptrend.”

Goldman Sachs (India arm): “India remains a top overweight in EM allocation, especially in sectors linked to domestic consumption and capex cycles.”

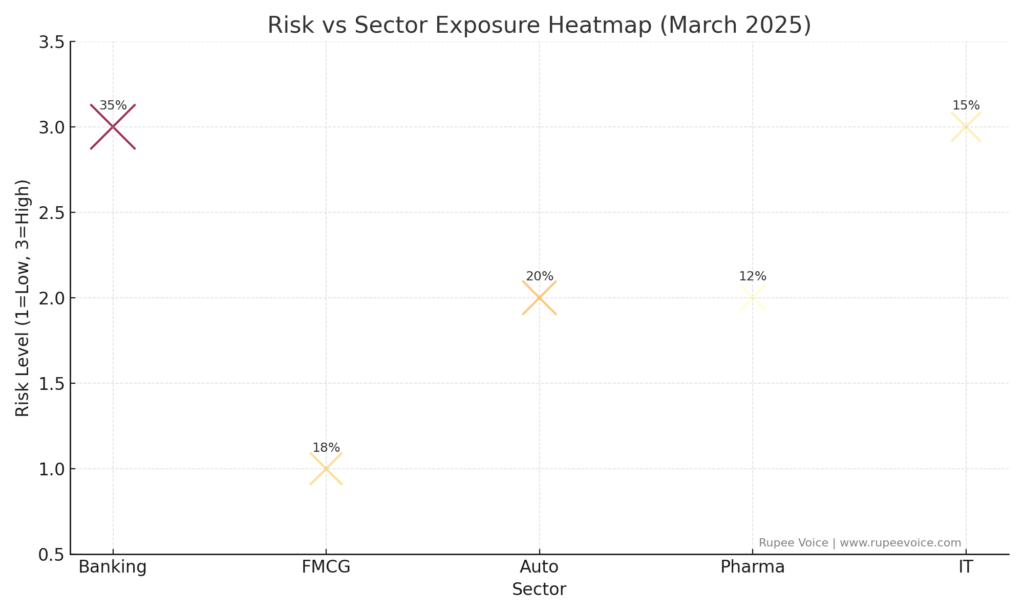

⚠️ Key Risk Factors to Watch

| Risk Factor | Impact | Mitigation Strategy |

|---|---|---|

| US Fed Policy & Rate Cuts | Sudden hawkish tone can trigger sell-offs | Use hedged options, diversify globally |

| Crude Oil Fluctuations | Input cost pressure, inflation risk | Stick to low-beta domestic sectors |

| Geo-political Events | Sudden corrections possible | Avoid leveraged positions |

| Earnings Misses in Q4 | Could trigger valuation corrections | Focus on stocks with strong EPS consistency |

| Expiry Week Volatility | Option sellers at risk | Avoid aggressive short straddles |

🎯 Trading & Investment Strategy (March 24–28)

🟩 For Traders:

- Nifty Intraday Range: 23,200 – 23,800

- Use buy-on-dips strategy till expiry

- Prefer bull call spreads over naked options

- Track Bank Nifty closely for early cues

- Sectors to trade: Banking, Auto, Infra

🟦 For Short-Term Investors (Next 2–3 Months):

- Focus on large-cap banking (ICICI Bank, HDFC Bank)

- Hold positions in auto and infra (Tata Motors, L&T)

- Start SIPs in Flexi-cap mutual funds or Nifty Next 50 ETFs

- Use dips for accumulating dividend-yielding PSU stocks

🟨 For Long-Term Investors:

- Maintain core portfolio in index ETFs + large-cap stocks

- Allocate 10–15% in international ETFs (like Nasdaq 100)

- Accumulate select mid-caps via mutual funds (SBI Small Cap, Axis Midcap)

- Avoid overexposure to high-valuation stocks

📊 Chart 6: Risk vs Sector Exposure Matrix

🧾 Final Takeaway

The Indian stock market has turned a critical corner as it enters the March expiry week. The combination of positive technical setups, strong mutual fund flows, stable FII activity, and encouraging economic signals presents a compelling case for cautious participation.

Investors and traders should:

- Stay disciplined

- Respect stop losses

- Prioritize capital protection

By following this research framework, market participants can confidently position themselves for the coming week and quarter.

DISLAIMER:

INVESTMENT TO STOCK AND SECURITY MARKETS ARE SUBJECT TO RISK. DO YOUR OWN ANALYSIS AND INFERENCES BEFORE INVESTMENT. RUPEE VOICE CONTENT IS GIVEN WITH A RESEARCH OUTCOME AND THE OUTCOMES ARE ALWAYS MAY NOT BE CORRECT OR THE INFERENCES CAN BE WRONG.

Prepared by: The Rupee Voice Research Desk

Date: March 24, 2025

Leave a Reply